see bottom of page for downloadable fund literature

RECURRENT MLP & INFRASTRUCTURE FUND (RMLPX)

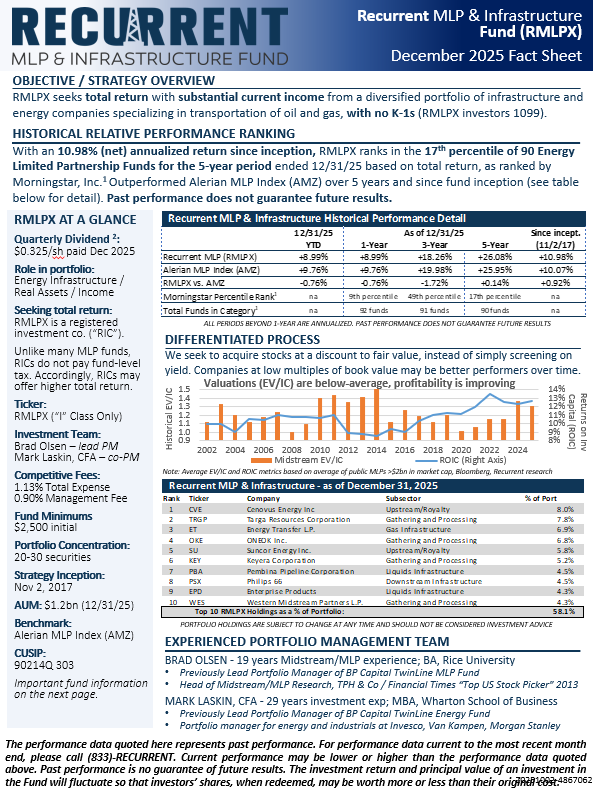

0.90% management fee; 1.13% total expense.

Objective: Total return and current income from MLP and pipeline infrastructure investments.

Structure: Registered investment company (RIC); RMLPX is a 1099 issuer; does not issue K-1s.

Dividends²: $0.325 paid quarterly. Dividends have historically been comprised of returns of capital (not taxable when received) as well as qualified and ordinary dividends (taxable when received at capital gains rates or ordinary income rates).

PORTFOLIO MANAGEMENT TEAM

- Lead Portfolio Manager: Brad Olsen

Relevant Experience: Brad has 18 years of MLP & infrastructure investment experience. He has overseen midstream investments for Recurrent for the past 7 years. Prior to Recurrent, Brad oversaw midstream investments at BPCFA. Brad also has investment experience at Eagle Global and Millennium.

As head of midstream research at TPH, Brad received several awards for stock picking excellence from the Financial Times, WSJ and Starmine in 2013 and 2014.

- Co-Portfolio Manager: Mark Laskin

Relevant Experience: Mark has 28 years of investing and portfolio management experience. He has overseen natural resources investing for Recurrent for the last 7 years. Prior to Recurrent, Mark oversaw energy investments at BP Capital Fund Advisors, Invesco, and Van Kampen.

Immediately prior to Recurrent, Mark served as CIO and PM of BP Capital Fund Advisors (BPCFA), a fund management company where Mark helped grow AUM while maintaining strong risk-adjusted performance in BPCFA's natural resources and midstream strategies.

1. © 2025 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Morningstar Percentile Rankings are based on the average annual total returns of the funds in the category for the periods stated and do not include any sales charges or redemption fees. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. Rankings for each share class will vary due to different expenses.

2. Dividends are subject to change and there is no assurance that they will continue to be paid.