1. © 2024 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

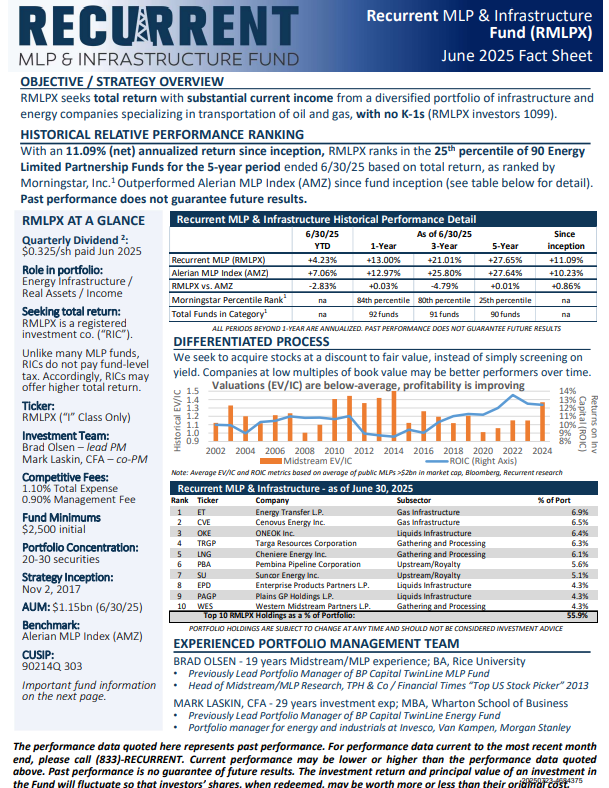

Morningstar Percentile Rankings are based on the average annual total returns of the funds in the category for the periods stated and do not include any sales charges or redemption fees. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. Rankings for each share class will vary due to different expenses.

2. Dividends are subject to change and there is no assurance that they will continue to be paid.

3. The Fund's current total expense ratio is 1.10%. advisor has contractually agreed to reduce its fees to a maximum of 1.25% until March 1, 2025. Without the waiver, total annual operating expenses would be 1.25% for RMLPX per the current prospectus (waiver was not used in the fiscal year ended October 31, 2023).

This presentation makes use of a variety of financial terms, defined below:

Enterprise Value: The market value of a company’s equity, debt (net of cash) and preferred/mezzanine claims.

Book Value: The stated book value of a company’s shareholders’ equity and total debt outstanding, net of cash and equivalents, as found in the balance sheet shown in the financial statements in their public filings.

Alerian MLP Index - is a composite of the 50 most prominent energy master limited partnerships calculated by Standard & Poor's using a float-adjusted market capitalization methodology. Investments cannot be made in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges. Alerian MLP Index - is a composite of the 50 most prominent energy master limited partnerships calculated by Standard & Poor's using a float-adjusted market capitalization methodology. Investments cannot be made in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.